Personas

From the user interviews, we realized that there are three dimensions along which our target users mainly will differ:

- Their level of financial literacy.

- Their level of confidence in their current financial situation and financial knowledge.

- What part of life they are in (underclass(wo)man, upperclass(wo)man, or recent college graduate).

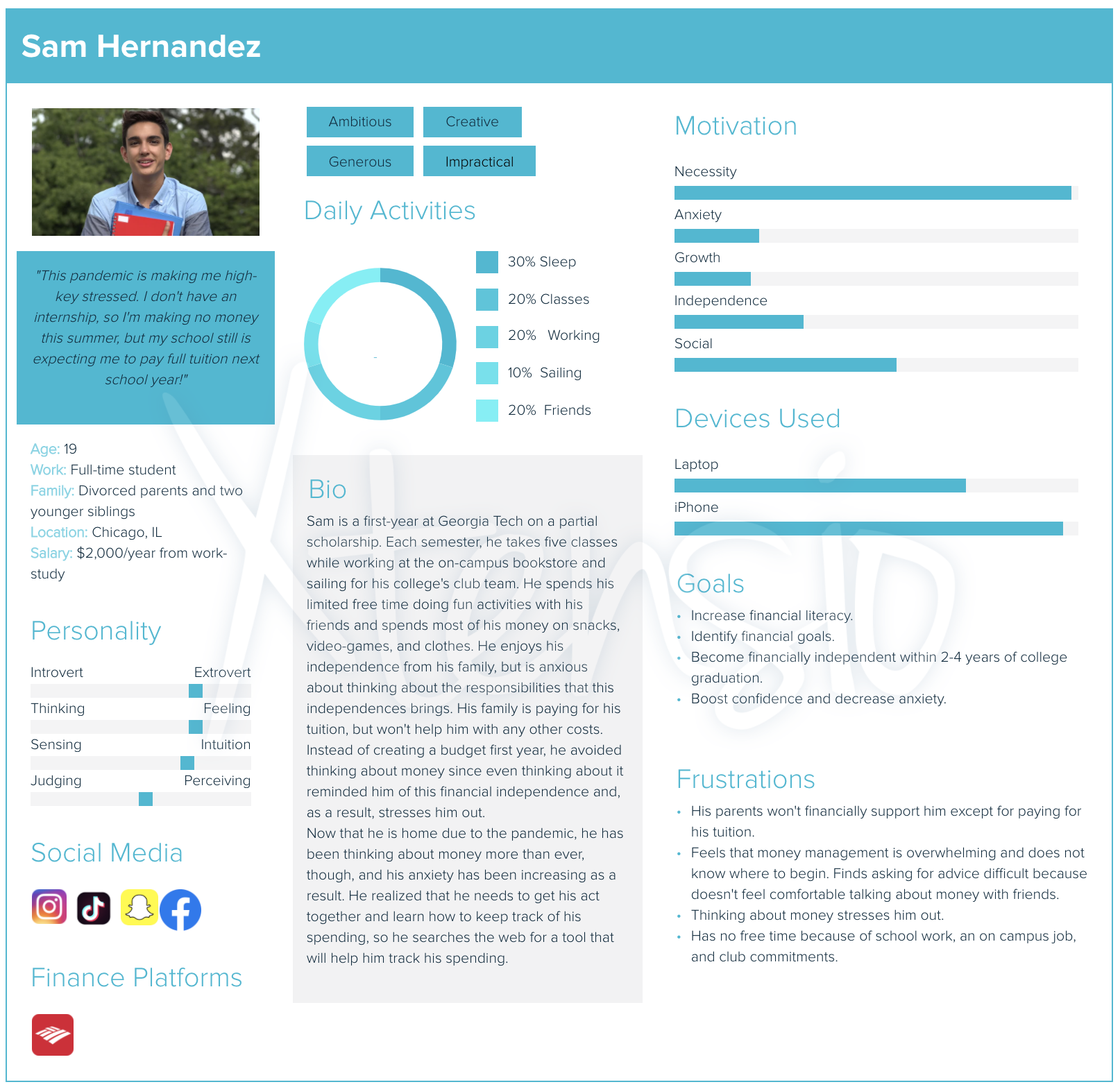

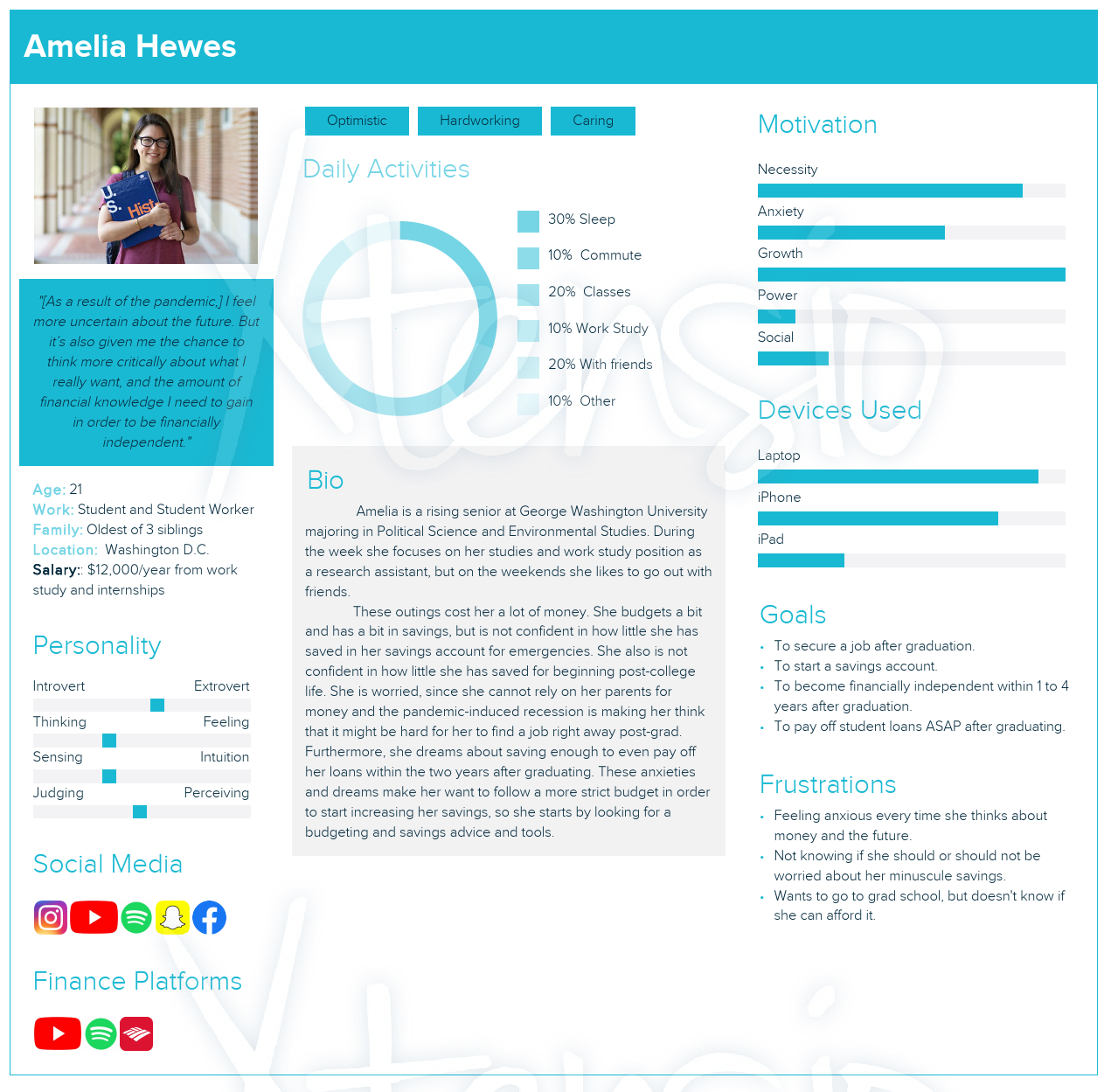

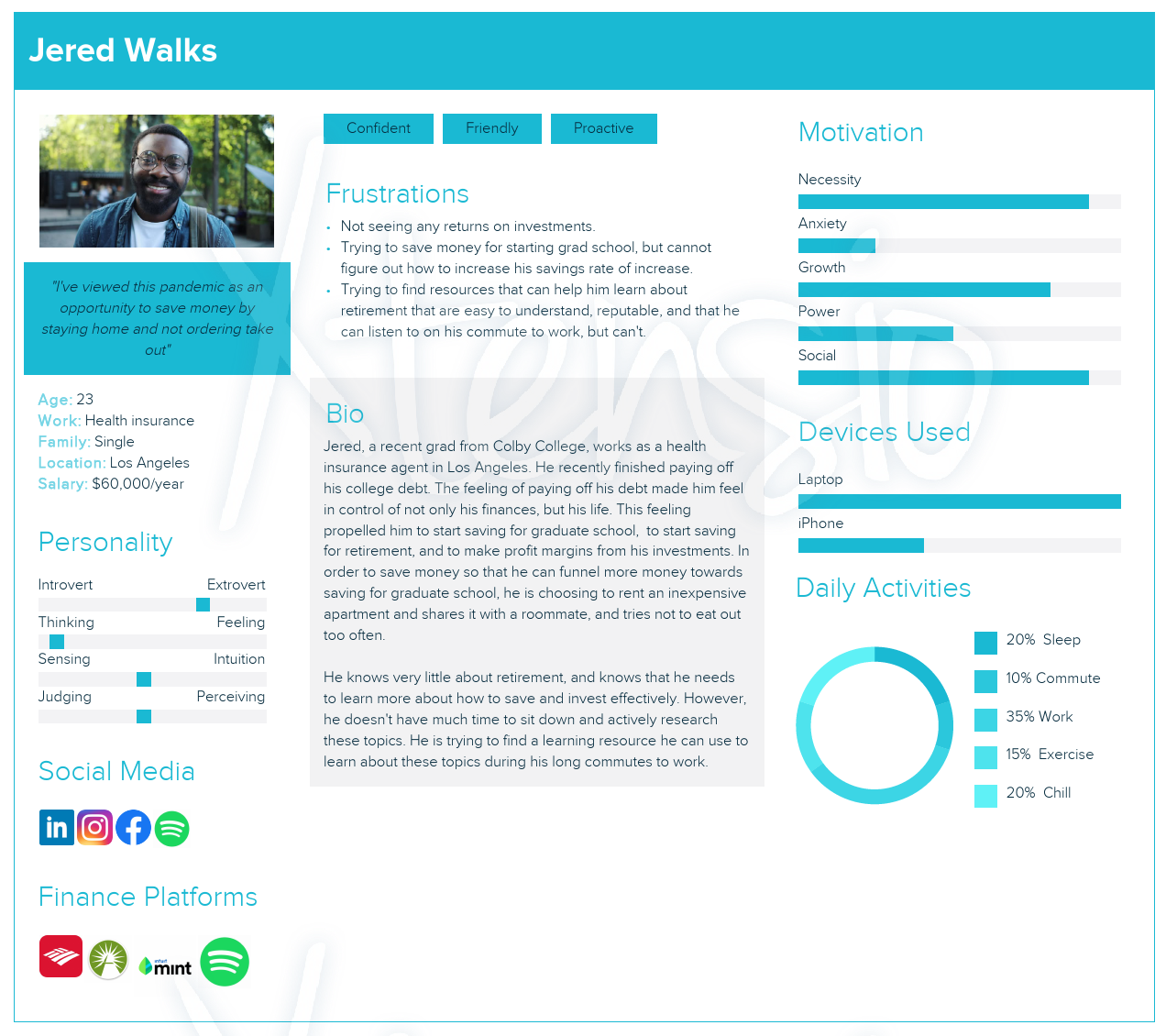

We created three personas to represent, understand, and empathize better with users who embody these dimensions differently.

- Sam represents college underclass(wo)men who have a low level of financial literacy and that are anxious about their finances as a result.

- Amelia represents college upperclass(wo)men who have a medium level of financial literacy and who are semi-anxious about their finances.

- Jered represents recent college graduates who have a relatively high level of financial literacy and who are less anxious about their finances, but who still desire to learn how to improve their personal finances in certain ways.

.png)

.png)

.png)